To encourage entrepreneurship and to accelerate Economic growth through “Start-Up India” Scheme, Govt. of India…

To encourage entrepreneurship and to accelerate Economic growth through “Start-Up India” Scheme, Govt. of India is offering Tax Holiday for 3 years under section 80IAC of Income Tax Act, 1961 to Eligible Startups running Eligible Business. A Start-Up has to obtain 2 certificates, one for Eligible Startup and another certificate for tax benefits i.e. for…

It is fairly well established that significant tax and investment reforms can have major effects on business Investments. With the most open economy along with significant Tax reforms, the Indian Government has certainly put India ahead of all countries to attract business and thereby creating growth opportunities for global businesses and growth of the country….

Very systematically fight against black money is being pursued both inside and outside India. This is possibly the first time in Independent India that vigorous fight is being done in a much-planned manner. Just look at the steps taken for tracking undisclosed assets, black money and closing the routes of tax-free movement of money with…

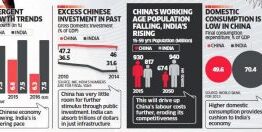

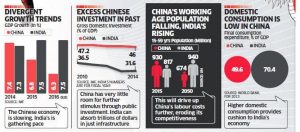

Surveys and reports all over the world predict that by 2030, India could be the rising economic powerhouse of the world as China is seen today. As the world’s largest economic power, China is expected to remain ahead of India, but the gap could begin to close by 2030. Various reports suggest that India’s rate…